Yes! You can use AI to fill out Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund

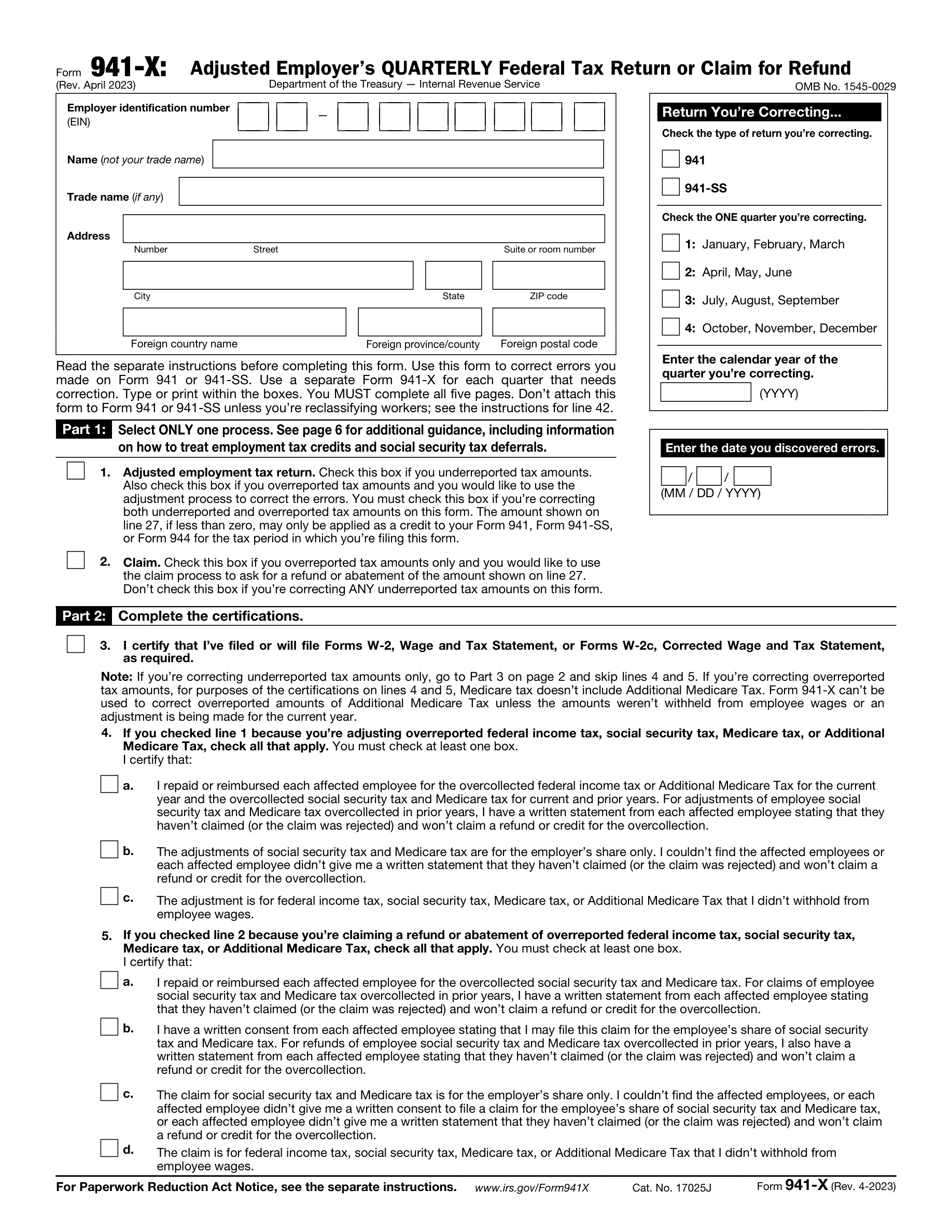

Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, is used by employers to correct errors made on Form 941 or 941-SS. It is important to fill out this form to ensure accurate reporting of employment taxes and to claim any refunds due for overreported amounts.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 941-X using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund |

| Form issued by: | Department of the Treasury — Internal Revenue Service |

| Number of fields: | 375 |

| Number of pages: | 6 |

| Version: | 2023 |

| Form page: | https://www.irs.gov/forms-pubs/about-form-941-x |

| Official download URL: | https://www.irs.gov/pub/irs-pdf/f941x.pdf |

| Language: | English |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 941-X Online for Free in 2025

Are you looking to fill out a FORM 941-X form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2025, allowing you to complete your FORM 941-X form in just 37 seconds or less.

Follow these steps to fill out your FORM 941-X form online using Instafill.ai:

- 1 Visit instafill.ai site and select Form 941-X.

- 2 Enter employer identification number (EIN).

- 3 Fill in the name and address fields.

- 4 Select the process for correction.

- 5 Complete all required parts of the form.

- 6 Sign and date the form electronically.

- 7 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 941-X Form?

Speed

Complete your Form 941-X in as little as 37 seconds.

Up-to-Date

Always use the latest 2025 Form 941-X form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 941-X

Form 941-X is used to correct errors on previously filed Form 941 or 941-SS, such as underreported or overreported tax amounts. It allows employers to adjust their employment tax returns or claim refunds or abatements for overreported amounts.

All five pages of Form 941-X must be completed and signed by the employer.

Form 941-X can be used to correct overreported amounts of Additional Medicare Tax only if the amounts weren't withheld from employee wages or an adjustment is being made for the current year.

If you're correcting both underreported and overreported tax amounts on Form 941-X, you must check the box for 'Adjusted employment tax return' in Part 1.

Use the claim process if you overreported tax amounts only and would like to request a refund or abatement of the amount shown on line 27. Do not use this process if you're correcting any underreported tax amounts.

When adjusting overreported tax amounts, you must certify that you have repaid or reimbursed affected employees for the overcollected taxes and, in certain cases, have written statements from them confirming they haven't claimed and won't claim a refund or credit for the overcollection.

On Form 941-X, you must check the box corresponding to the quarter you're correcting and enter the calendar year of that quarter.

If you discover errors after filing your original Form 941, you should file Form 941-X to correct the errors. Enter the date you discovered the errors and provide a detailed explanation of the corrections in Part 4.

No, do not attach Form 941-X to Form 941 or 941-SS unless you're reclassifying workers. Instead, file Form 941-X separately for each quarter that needs correction.

If line 27 is less than zero and you checked the 'Adjusted employment tax return' box, the amount is applied as a credit to your Form 941 or 941-SS for the tax period in which you're filing this form. If you checked the 'Claim' box, the amount is what you want refunded or abated.

Compliance Form 941-X

Validation Checks by Instafill.ai

1

Form Type and Version Verification

Ensures that the form being processed is the correct type '941-X' and matches the specified form version 'April 2023'. This is crucial to ensure compliance with the latest tax regulations and to avoid processing outdated forms.

2

OMB Number Match

Confirms that the Office of Management and Budget (OMB) number '1545-0029' is present and accurate. This number is a unique identifier for the form and is required for federal approval.

3

Employer Identification Number (EIN) Validation

Verifies that the employer's EIN is entered correctly in the Identification section. The EIN is a fundamental identifier for the employer and must be accurately reported for tax purposes.

4

Employer Legal Name Entry

Checks that the legal name of the employer is entered correctly, distinguishing it from any trade name that may be used. This ensures legal clarity and proper tax reporting.

5

Trade Name Distinction

Verifies that the trade name, if different from the legal name, is entered correctly. This helps in maintaining the distinction between the legal entity and the name under which it does business.

6

Employer Address Completion

Ensures that the employer's address is fully and accurately provided, including all necessary details such as street number, suite or room number, city, state, and ZIP code. For foreign addresses, additional details are verified.

7

Process Selection Confirmation

Confirms that only one process is selected in Part 1, as required by the form instructions. This is essential to prevent conflicting information and processing errors.

8

Certification for Filing Forms W-2/W-2c

Verifies that the certification for filing Forms W-2 or W-2c is checked, ensuring that the employer has complied with the necessary filing requirements.

9

Adjustments and Claims Certification

Checks that the certifications for adjustments and claims of overreported taxes are correctly completed according to the instructions provided, including all applicable checkboxes.

10

Correction Entries in Part 3

Ensures that all correction entries in Part 3 are accurately calculated and entered, including the total corrected amounts, originally reported amounts, and the differences for each line item.

11

Explanation of Corrections Clarity

Verifies that the explanation of corrections in Part 4 is detailed and clear, providing a comprehensive account of how the corrections were determined.

12

Authorized Signature Verification

Confirms that the form is signed and dated by an authorized individual, and that the title and daytime phone number are provided. If a paid preparer is used, their information is also checked for completeness.

13

Separate Form for Each Quarter

Ensures that a separate Form 941-X is used for each quarter requiring correction, as stipulated in the additional notes.

14

Form Completion and Printing Guidelines

Verifies that the form is filled out according to the instructions, with typing or printing within the boxes and all five pages completed as required.

15

Attachment and Reclassification Rules

Checks that the form is not attached to Form 941 or 941-SS unless it is for the purpose of reclassifying workers, in accordance with the additional notes.

Common Mistakes in Completing Form 941-X

A common mistake is entering an incorrect Employer Identification Number (EIN). Ensure that the EIN matches the number assigned by the IRS and is entered correctly. Double-check the number for transposition errors or omissions, as an incorrect EIN can lead to processing delays or misidentification.

Filers sometimes enter the trade name in the field designated for the legal name of the employer. It's important to enter the legal name as registered with the IRS in the 'Name' field and only use the 'Trade name' field if it differs from the legal name. This helps in accurately identifying the business entity.

Leaving out parts of the address or entering an incorrect address is a frequent error. Make sure to include the full address details, such as number, street, suite or room number, city, state, and ZIP code. For foreign addresses, include the country name, province/county, and postal code to ensure proper handling.

A critical error is checking more than one box in Part 1, where you must select only one process. Decide whether you are filing an adjusted employment tax return or a claim and check the appropriate box. Selecting multiple options can invalidate the form.

Omitting the certifications in Part 2 can lead to the rejection of the form. Ensure that all relevant certifications are checked, indicating compliance with the conditions for adjustments or claims. This is a declaration of accuracy and should not be overlooked.

Errors in entering the corrected amounts, originally reported amounts, or the differences can lead to incorrect tax calculations. Carefully review the corrections for accuracy and use the tax correction column to calculate the corrected tax based on the differences.

Providing a vague or incomplete explanation of corrections in Part 4 can cause confusion. Provide a detailed and clear explanation of how the corrections were determined, including any underreported and overreported amounts, to facilitate understanding and processing.

Forgetting to sign or date the form in Part 5 is a common oversight. The form must be signed and dated by the employer or an authorized representative. Ensure that the title and the best daytime phone number are also included. If a paid preparer is used, their information must be entered as well.

Using a single Form 941-X for corrections pertaining to multiple quarters is incorrect. Use a separate Form 941-X for each quarter that needs correction to avoid processing issues and to ensure that each quarter's corrections are clearly documented.

Ignoring the additional notes and specific instructions can lead to errors. Always type or print within the boxes, complete all five pages, and do not attach this form to Form 941 or 941-SS unless reclassifying workers. Refer to the separate instructions for detailed guidance.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills 941-x forms, ensuring each field is accurate.